The Hidden Cost of 'Good Enough' Testing: Why Your Board Doesn't Understand QA ROI

Your CFO sees QA as a cost center because you're speaking the wrong language. Here's how to translate test coverage into revenue protection.

You walk into the quarterly budget meeting armed with charts showing 85% test coverage, reduced flakiness rates, and improved CI/CD velocity. Your CFO nods politely, then asks: "But how much revenue did this generate?"

Silence. Because you know—and I know—that QA doesn't generate revenue. It prevents catastrophic loss. But "catastrophic loss prevention" is invisible until it fails. And therein lies the eternal war between engineering teams who understand quality debt and executives who only see delayed releases.

The Invisible Tax of Technical Metrics

Here's the uncomfortable truth: your board doesn't care about test coverage percentages. They don't care about your flaky test count or how many unit tests you added this sprint. These metrics mean absolutely nothing to people who measure success in ARR, churn rate, and customer acquisition cost.

When you present technical QA metrics to non-technical executives, you're essentially speaking Klingon. They smile, nod, and mentally categorize QA as "that thing engineering needs that slows down shipping."

The problem isn't that executives are anti-quality. The problem is that you're asking them to trust a black box. You're saying: "Give me $500K for testing infrastructure, and in return, I promise that bad things won't happen."

That's not a business case. That's a protection racket.

The Real Cost Calculation Nobody Wants to Do

Let's talk numbers. Real numbers. Not "testing is important" platitudes, but actual financial impact calculations that make CFOs pay attention.

Start with this framework:

- Production incident cost = (Revenue lost during downtime) + (Customer churn from poor experience) + (Engineering time to hotfix) + (Support ticket surge handling) + (Reputation damage)

- Testing infrastructure cost = (Tooling licenses) + (CI/CD compute) + (QA engineer salaries) + (Test maintenance overhead)

- Break-even threshold = How many production incidents must you prevent per year to justify the testing investment?

Most companies discover that preventing just 2-3 major production incidents per year completely justifies their entire QA budget. The math is brutal and obvious once you actually run it.

But here's the dark secret: most engineering leaders have never calculated this number. They advocate for testing on principle, not on ROI. And principles don't win budget battles.

Why 'Move Fast and Break Things' Is a Monopoly Luxury

Facebook could afford to move fast and break things because they had no competition. If Instagram went down for an hour, users didn't switch to a competitor—they just waited.

Your startup doesn't have that luxury. You have eight well-funded competitors who would love nothing more than for your app to crash during a product launch. Every production bug is a customer acquisition gift to your rivals.

The real question isn't "Can we afford comprehensive testing?" It's "Can we afford not to have it while competitors are breathing down our necks?"

When your board pushes back on QA investment, what they're really saying is: "I believe our competitive advantage is strong enough to survive quality issues." Make them say that out loud. Make them own that assumption.

The Translation Layer: Speaking CFO

Here's how to reframe your QA metrics in language that makes executives listen:

- Instead of: "We increased test coverage from 60% to 85%"

Say: "We reduced production incident risk by 40%, protecting approximately $1.2M in annual revenue exposure" - Instead of: "Our CI/CD pipeline runs 2,400 tests on every commit"

Say: "We catch breaking changes before they reach customers, preventing an estimated 18 support escalations per month (saving $54K annually in support costs)" - Instead of: "We need to invest in visual regression testing tools"

Say: "UI bugs caused 3 emergency rollbacks last quarter, costing 120 engineering hours ($36K). Visual regression testing would have caught these before deployment for $12K annually—a 3x ROI" - Instead of: "Test flakiness is slowing down our velocity"

Say: "Flaky tests force engineers to re-run CI pipelines 40% of the time, wasting 15 hours per week ($180K annually) and delaying feature releases by an average of 2 days"

Notice the pattern? Every technical metric gets translated into either revenue protected or cost avoided. This is the language of business justification.

The Production-Ready ROI Framework

Here's a battle-tested framework for presenting QA ROI to your board. Use this template for your next budget meeting:

1. Historical Incident Analysis

Document every production incident from the past 12 months:

- Date and duration of outage/degradation

- Revenue lost during incident (calculate average revenue per hour × downtime)

- Customer churn attributed to the incident (survey data or support ticket analysis)

- Engineering hours spent on emergency response and hotfixes

- Could this have been caught by automated testing? (Be honest.)

This creates your baseline: "Here's what inadequate testing actually cost us last year."

2. Testing Investment Proposal

Present your QA budget request broken down by impact area:

- Incident Prevention: Tools and infrastructure that would have caught historical incidents

- Velocity Protection: Investments that prevent testing from becoming a bottleneck (parallel test execution, smart test selection)

- Maintenance Reduction: Flakiness elimination, test refactoring, better test isolation

For each category, show the direct financial benefit using historical data.

3. Competitive Benchmarking

Research what your competitors are doing (check their engineering blogs, conference talks, job postings for QA roles). Show that you're not asking for gold-plated luxury—you're asking for table stakes in your industry.

"Three of our top competitors have dedicated performance testing teams. We're trying to compete with a single QA engineer manually testing critical paths."

4. Phased Rollout Plan

Don't ask for everything at once. Show a 12-month roadmap:

- Q1: High-impact, low-cost wins (fix flaky tests, add smoke tests for critical paths)

- Q2: Visual regression testing for UI-heavy features (prevents costly rollbacks)

- Q3: Performance testing infrastructure (catches scalability issues before Black Friday)

- Q4: Chaos engineering and resilience testing (ultimate revenue protection)

Each phase should show measurable results that justify the next phase's investment.

The Uncomfortable Conversation About Acceptable Risk

Here's the conversation most CTOs avoid having with their board: "How much production risk are we willing to accept?"

This is a business decision, not a technical one. Your job as a technical leader is to quantify the risk levels and let executives choose their acceptable threshold.

Frame it like this:

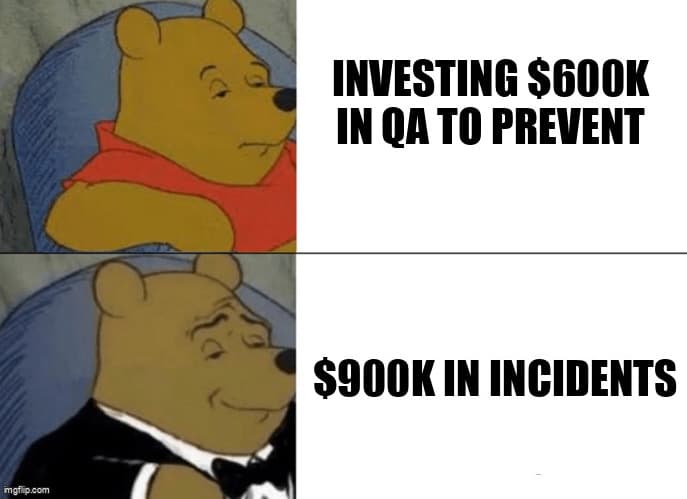

- Scenario A: Current testing investment ($300K/year). Historical incident rate: 6 major incidents per year. Average incident cost: $150K. Expected annual incident cost: $900K.

- Scenario B: Proposed testing investment ($600K/year). Projected incident rate: 2 major incidents per year (based on incident root cause analysis). Expected annual incident cost: $300K. Net savings: $300K.

- Scenario C: Minimal testing investment ($100K/year). Projected incident rate: 10+ major incidents per year. Expected annual incident cost: $1.5M+. This is the "move fast and pray" strategy.

Present these scenarios without judgment. Your CFO might legitimately choose Scenario C if you're in a land-grab phase where market share matters more than stability. That's a valid business decision—but they need to make it with eyes wide open.

The Secret Weapon: Leading Indicators

Once you secure QA investment, don't wait for production incidents to prove value. Track and report leading indicators that executives can understand:

- Critical bugs caught in testing vs. production: Show the trend improving over time

- Mean time to detect issues: Demonstrate that you're catching problems faster

- Customer-reported bugs vs. internally caught bugs: Shift the ratio in your favor

- Release rollback rate: This should trend toward zero

- Time from code commit to production: Prove that quality doesn't slow you down

Report these metrics monthly in business terms. "This month, we caught 12 critical bugs before customer impact, protecting an estimated $180K in revenue and support costs."

The Final Truth

Your board doesn't understand QA ROI because you haven't taught them. They're not stupid—they're busy optimizing for different metrics. Your job is to connect the dots between test coverage and revenue protection in language they already speak.

Stop defending testing on principle. Start defending it with math. Calculate the actual cost of production incidents. Show the historical trend. Demonstrate the ROI of prevention. Make the business case so obvious that saying no to QA investment feels reckless.

Because here's the thing: your competitors are doing this math. They're investing in quality assurance not because they love testing, but because they've calculated that it's cheaper than losing customers.

The question isn't whether your board will fund comprehensive testing. The question is whether they'll fund it before or after the next catastrophic production incident forces their hand.

Choose wisely. The math doesn't lie.